I’m a builder, not a scientist. I don’t spend my days arguing about carbon targets. But I do spend my days on muddy sites, looking at water where it didn’t used to sit and ground that doesn’t behave the way it did 20 years ago.

Whatever anyone thinks caused it, you’d have to be wilfully blind not to see that the climate has changed.

Which means we should be planning for the world we’re actually in now, not trying to shove the genie back in the bottle and pretend it’s 1995. That means changing how and where we build.

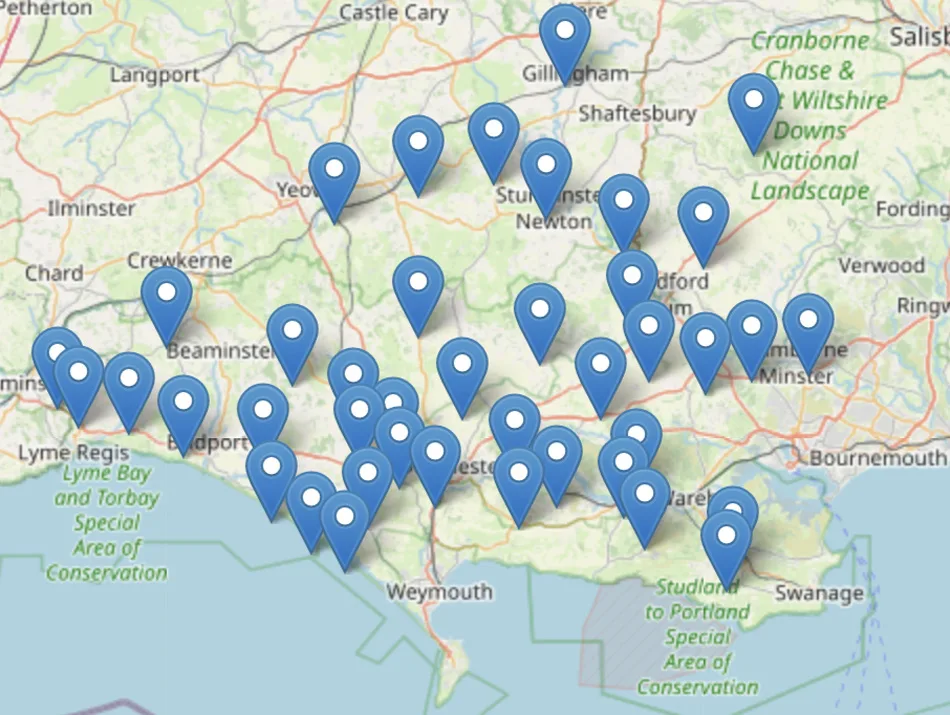

So here’s a simple question. During the recent floods, did any local council send a drone up, take some pictures, overlay them on a map and draw a thick red line that said “no building inside this”? Because if not, why not?

We can – but we shouldn’t

Just because we can engineer our way around flood risk doesn’t mean we should. Just because we can pile concrete into groundwater-prone slopes doesn’t mean we should. Just because we can prop up unstable land with steel, drains and clever drawings doesn’t mean we should.

And just because developers know they can drown overstretched planning departments in paperwork – thousands of pages, buried figures, selective surveys – until something important will get neatly missed, doesn’t mean we should be letting them build in places every local person knows are totally unsuitable. I’ve read about the Fingleton Review saying nature protections place ‘unnecessary costs’ on developers. From where I’m standing, that sounds like a pair of bull’s testicles. Protecting nature isn’t a luxury! It’s flood management. It’s slope stability. It’s future-proofing. And it’s cheaper than fixing failures later. Anyone who’s ever been called back to a job that’s gone wrong knows that.

What really sticks, though, is who pays when it all goes wrong? It isn’t the big developers. It’s the people buying the houses – paying top money for homes that are value-engineered, tightly packed and sold with glossy brochures … but very little margin for error.

Meanwhile, the land keeps the memory of where water wants to go, whether we like it or not.

Good building used to mean understanding the land first. Somewhere along the line, we decided clever reports and profits mattered more than common sense. I’d suggest we’ve had enough proof lately that the land still wins.

The Grumbler – the open opinion column in The BV. It’s a space for anyone to share their thoughts freely. While the editor will need to know the identity of contributors, all pieces will be published anonymously. With just a few basic guidelines to ensure legality, safety and respect, this is an open forum for honest and unfiltered views. Got something you need to get off your chest? Send it to [email protected]. The Grumbler column is here for you: go on, say it. We dare you.