Dorset Councillors have agreed to impose a council tax premium on second homes in the county.

The introduction of the 100% council tax premium on second homes will come into effect on 1 April 2025, making a total council tax charge of 200% (effectively doubly the council tax bill). This charge applies from the moment a property is classified as a second home, with no grace period required.

For those properties classified as ‘Long-Term Empty and Unoccupied’ a 100% premium will, from 1 April 2024, be applied after one year rather than the existing 2 years.

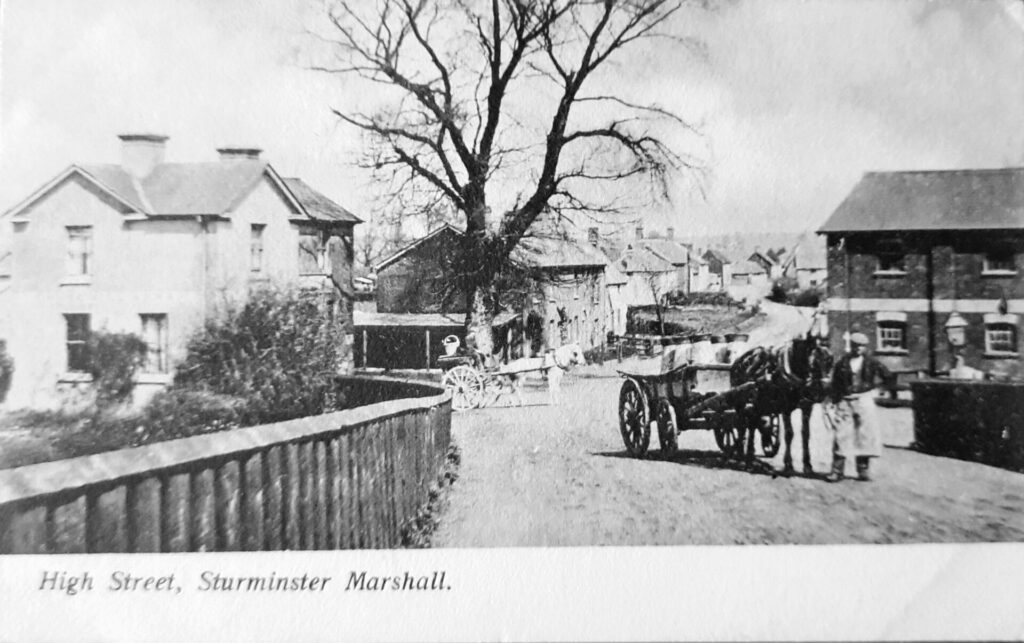

The issue of second homes was first covered by The BV in Feb 23 – latest data from the Office for National Statistics (ONS) has shown there are more than 2,000 second homes in Dorset – Dorset ranks third highest in the country, with a total of 2,490 holiday homes. It has been a growing issue in the county, with residents stating they are being priced out of buying homes in their area by Airbnbs and out-of-area buyers.

Cllr Jill Haynes, Dorset Council Portfolio Holder for Corporate Development and Transformation says: ‘The proposal to introduce council tax premiums on second homes and empty properties has been discussed in Dorset for several years.

‘Now that the government’s Levelling Up and Regeneration Bill has been passed and received Royal Assent, we will implement the changes and additional premiums in 2024 and 2025. Council agreed to use 40% of the additional monies raised to support the delivery of affordable housing.

‘These new powers will provide much needed additional funds to help the council continue our track record of protecting vital frontline services on which Dorset residents rely.’

Potential benefits of additional tax on second homes:

- Housing Affordability: Higher taxes on second homes can discourage the purchase of properties as investments or holiday homes, potentially reducing housing prices and making homes more affordable for local residents.

- Revenue Generation: The additional tax revenue can be used by local authorities to fund public services, infrastructure projects, and community development initiatives, improving overall quality of life in the area.

- Community Stability: By discouraging short-term and seasonal occupancy, such policies can lead to a more stable year-round population, which can strengthen community ties and local economies.

- Reduced Pressure on Local Resources: Second homes often remain empty for large parts of the year, yet they still require infrastructure and services such as roads, waste collection, and emergency services. Higher taxes could help offset these costs.

- Support for Local Businesses: A more stable and permanent population can provide consistent support to local businesses as opposed to the fluctuating demand driven by seasonal tourists.

Opposition voices suggest the higher costs for second home owners might discourage investment in holiday properties, potentially impacting the local tourism industry and businesses reliant on tourist spending.